KTL nâng cao

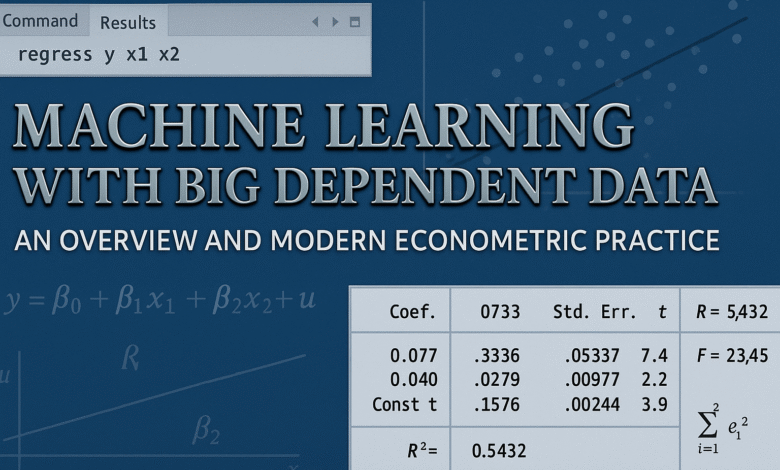

Machine learning với dữ liệu phụ thuộc lớn

Tổng quan và thực hành kinh tế lượng hiện đại

Chuỗi bài viết này cung cấp hướng dẫn toàn diện về các phương pháp machine learning hiện đại áp dụng cho dữ liệu phụ thuộc lớn trong kinh tế lượng, bao gồm: cây hồi quy và phân loại (regression/classification trees), rừng ngẫu nhiên (random forest), mạng nơ-ron và học sâu (deep learning). Nội dung được trình bày logic, tích hợp thực hành trên Stata, R, Python với dữ liệu mô phỏng duy nhất, giúp người đọc dễ dàng áp dụng vào thực tiễn nghiên cứu kinh tế – tài chính.